Should I Refinance my Car Right Now?

Refinancing an existing car

loan(Opens in a new window) is one way

to save some money and lower your debt. By refinancing you may be able to secure a lower

interest rate – potentially lowering your monthly payment – or shorten your term – meaning

you’re paying less overall and will eliminate that debt faster. There are important factors to

weigh, though, before hopping on the refi train.

We’ve rounded up the top four things to

consider before talking to your bank or credit union about a refi.

1. Your current loan status impacts potential savings from refinancing.

If you’re underwater – also known as upside down – on your car loan, it means that

you currently owe more than the car is actually worth. Having negative equity is a

tricky spot to be in and you’ll want to carefully discuss your options with any

potential lenders, including your current lender, before making a refinance

decision.

If your credit is good, you may be able to refinance your car loan

at a lower interest rate; don’t be tempted to opt for lower monthly payments,

though. Doing so will extend the life of your loan and could put you further

underwater on your loan, especially since cars lose their value year after

year.

Instead, opt to shorten the term, or length, of your loan. While your

monthly payments may not go down, you’ll pay your car loan off faster which will

help you escape the negative equity.

► Pro Tip: If you’re underwater on your

loan and your credit doesn’t warrant a refinance, try paying a bit extra on your

loan each month. You can talk to your lender about how much extra will help you get

to a place where you’re not holding negative equity.

2. Your credit impacts your ability to refinance.

Like so many of your financial decisions, your credit is going to matter. If your

credit is good, and interest rates have dropped since you purchased your car, you

will likely be able to refinance your loan at a lower rate. This could lower your

payment and save you money on interest.

Even if rates have not gone down

drastically, refinancing your car can still save you money. If you’ve paid a chunk

of your car off, refinancing can lower your overall balance, saving you money with

lower monthly payments or a shorter term.

Refinancing to either shorten or

extend your term can also save you money. Let’s look at two examples.

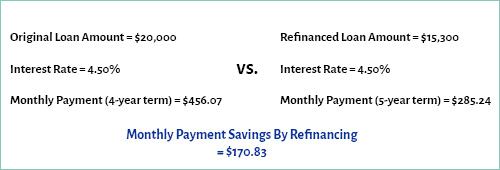

In this

example, you can see that by refinancing for an extended (longer) term after one

year of payments you can reduce your monthly payment. You will end up paying more

towards interest, but if you need to improve your monthly cash flow this could be an

option for you.

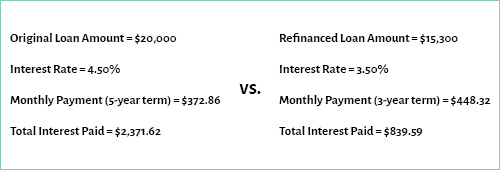

In the next example, refinancing after one year of payments is saving you

money by shortening the term, saving you in overall interest paid.

► Pro Tip:

Ideally, you don’t want to add months or years to your car loan. If you’re in

serious need of extra cash, though, refinancing your loan for a longer term could

lower your monthly payments and improve your cash flow.

If your credit

isn’t as healthy as it should be, refinancing your car loan may not make sense right

now because you may be not able to secure a favorable interest rate. Take a look at

this

article for information on how you can improve your credit.

Even if refinancing doesn’t work right now, improving your credit over the next few

months can make that opportunity available to you in the future.

NEED MORE INFO ON YOUR CREDIT? Check out our Understanding Credit presentation. This recorded webinar walks you through what credit is, what you’re potentially doing to hurt it, and how to improve it. Watch now!(Opens in a new window)

3. The age of your car impacts your refinance savings.

How old is your car? Believe it or not, its age will help you decide whether

refinancing your car right now is the best move. Generally speaking, the older your

vehicle is, the higher your interest rate will be. This means that if you originally

purchased a used car, and it’s even older now, your refinanced interest rate may end

up being higher. Talk to potential lenders and your current financial institution to

get a good understanding of whether refinancing would make sense with the age of

your car.

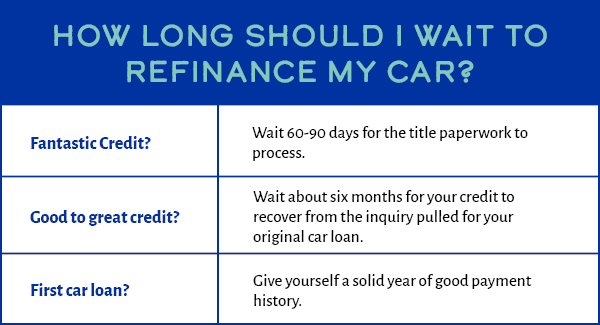

On the flip side of that, refinancing too soon after the purchase

may not be the best move, either. When you applied for your original car loan, the

lender ran your credit which likely resulted in a bit of a dip in your score. Give

yourself at least six months to recover from that inquiry before you apply for a

refinance, and keep in mind that opening a new loan – even a refinance – will impact

your credit.

Is this your first car loan? Wait even longer than six months.

Lenders are going to want to see at least a year of good payment history on your car

loan.

4. Your mileage impacts your potential refinance savings.

Have a thing for road trips? If you’ve racked up some serious miles, it may not make

sense to refinance your loan. The more miles a car has, the more its value has

depreciated or gone down. And the less value a car has, the less likely a lender

will be to refinance.

If you’ve put more than 90,000 miles on your car, your

lender may be hesitant to refinance your loan, or you may not get an interest rate

that would save you money. Your best bet is to talk to your lender – and several

others if need be – to see if refinancing is a viable option.

Here’s when refinancing may not be the best option.

While you can potentially save money by refinancing, there are a few reasons to hold

off. First, check the terms of your original loan. Does it have a prepayment or

early repayment penalty? Some loans include this fee to recapture interest the

lender will lose by the loan being paid off sooner than anticipated. If your

original loan does include this fee, you’ll want to weigh it against any savings you

may realize with a refi. Does the cost outweigh the benefit? If not, refinancing may

not be the right option.

Another thing to consider is your future need for

credit. For example, if you plan on applying for a mortgage soon, you’re going to

want your credit to be as squeaky clean as possible. Applying for a refi means your

lender will pull your credit, what’s known as a hard pull. This could cause your

credit score to temporarily dip. And when you’re trying to lock in a favorable

mortgage rate, every point on your credit score is going to matter.

Like any

financial decision, it’s important to weigh the pros and cons of refinancing against

your own personal financial situation and goals. Perhaps the most important step is

talking to your lender; they can provide you the options that best meet your

specific needs.

Ready to Apply for a Car Loan?

Other Auto articles you may be interested in

- Family driving in a carAuto

5 Steps to Take Before Buying a New Car

Discover how to simplify car buying with this guide, including finance management, getting pre-approved for a car loan, and negotiation strategies. - Couple at car dealershipAuto

Expert Tips and Tricks for Buying a Car Without Breaking the Bank

Buy a car without draining your bank account. Get proven tips and tricks for saving money when you purchase a vehicle, from negotiating with dealerships to choosing the right financing options. - car for saleAuto

How to Buy a Car From a Private Seller

Sometimes you don’t find your dream car at the dealership but from a private seller: a friend, neighbor, or even a complete stranger whose advertisement you happened to see.