Get Started Today

Fill out the form to start the mortgage process. A home loan expert will be in contact with you shortly.

Today's Mortgage Rates

30 Year Fixed Rate

5.875

% Interest Rate

5.888

% APR*

Biweekly 30 Year Fixed

5.875

% Interest Rate

5.941

% APR*

SONYMA

5.400

% Interest Rate

5.372

% APR*

* Rates current as of

Renovation Financing: Buy The Fixer-Upper

Sometimes the house you want – or the only one your budget allows – needs a little love. With Renovation Financing, you may be able to roll a renovation loan into your mortgage. This unique solution means you get to buy the home and pay for the work it needs…while still only paying one mortgage payment a month.

Talk to a Mortgage Expert today to find out if your purchase could qualify for renovation financing.

Homeownership Starts in 5 Simple Steps

- 1

Get Prepared

There are a few ways you can get prepared. We’ll guide you through some considerations before you apply. - 2

Calculate

Use our calculator to determine your monthly payment. - 3

Pre-Qualify

Getting pre-qualified will tell you how much you can borrow so you can shop for your new house with confidence. - 4

Find a Home

An MHV Mortgage Expert can recommend a trusted Real Estate Agent to help you find and negotiate the price for your new dream home. - 5

Final Walkthrough & Closing

The closing is the last step in buying and financing a home. At your closing appointment, the Mortgage is finalized and the title of the house is transferred to you. You officially become a home owner!

Calculate Your Mortgage Payment

The PMI rate will vary based on credit score, down payment and other criteria.

Get Pre-Qualified

Getting pre-qualified proves that you’ve already lined up financing and have the ability to go through with the sale, which makes you a more attractive buyer to sellers.

Meet Our Mortgage Experts

Our Mortgage Experts will help guide you through the entire mortgage process and recommend a trusted realtor.

Rick Farrow

Mortgage Originator

Phone:845.527.2090

Email: rfarrow@mhvfcu.com

Branches Covered:

Newburgh, Rockland & Sullivan Counties

NMLS #: 800674

Visit Rick's Website

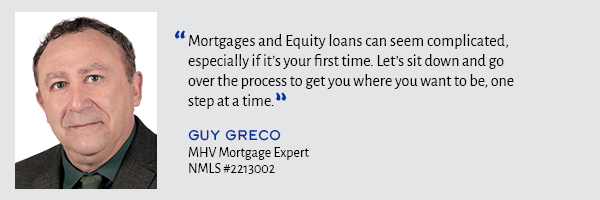

Guy Greco

Mortgage Originator

Phone:845.802.4072

Email: ggreco@mhvfcu.com

Branches Covered:

Kingston, Saugerties & Woodstock

NMLS #: 2213002

Visit Guy's Website

Tom McHugh

Mortgage Originator

Email: tmchugh@mhvfcu.com

Branches Covered:

LaGrange, Fishkill,

Putnam & Westchester Counties

NMLS #: 697524

Visit Tom's Website

Denise Quinn

Mortgage Originator

Phone:845.522.3844

Email: dquinn@mhvfcu.com

Branches Covered:

Middletown, Rockland & Sullivan Counties

NMLS #: 454310

Visit Denise's Website

Michael Riger

Mortgage Originator

Email: mriger@mhvfcu.com

Branches Covered:

Westchester, Putnam & Rockland Counties

NMLS #: 2662550

Visit Michael's Website

Bill Walsh

Mortgage Originator

Phone: 914.474.5194

Email: wwalsh@mhvfcu.com

Branches Covered:

Poughkeepsie & Putnam County

NMLS #: 454307

Visit Bill's Website

What is Needed for a Mortgage Application?

You may submit these documents through our Application portal

Last 2 years W2's and 2 current paystubs evidencing at least 30 days of year-to-date income

If self-employed: Last 2 years signed tax returns with all schedules

Last 2 months bank statements for all savings and checking accounts

How Long Does it Take?

Grab this download for the steps of a mortgage application, estimated timeframes, and a list of required documents.

Final Walkthrough & Closing

Before closing, it is recommended that you do a final walkthrough of the home to ensure its condition has not changed and that any features that were supposed to be included in the sale are still in place. On the closing day, the Mortgage is finalized and the title of the house is transferred to you.

Here are some tips:

Take all the time you need. You have a right to read and understand your closing documents, no matter how long it takes.

See what the Mid-Hudson Valley Has to Say About Us

- They are very helpful and they offer very professional service. Every time I have a question about anything, it gets handled quickly and efficiently.Sheila F.

- MHV has easy access to local branches, competitive rates on loans and mortgages, and easy loan application process. Good quality of service!Matthew B.

Apply in less than 15 minutes

Commonly Asked Questions About Mortgages

-

SONYMA mortgage is a mortgage through The State of New York Mortgage Agency (SONYMA). SONYMA specializes in mortgage programs to assist first-time homebuyers and those meeting certain income qualifications who are purchasing a home in New York State.

Click here for the home buyer programs we participate in.

- Please visit our Rates page for today's mortgage rates.

-

- First, you will know exactly how much house you can afford. This will help you focus your search and use your time more efficiently.

- Getting pre-qualified gives you buying power because the seller knows you have financing lined up, making you more attractive to them.

Learn more about mortgages and get pre-qualified here.

-

To apply for a home equity or mortgage refinance, please visit our Mortgage Center here.

If you have any questions about the loan application process, please contact us at 845.336.4444.

Rates, terms and conditions subject to change without notice. All loans subject to credit approval

*APR=Annual Percentage Rate. All loans subject to approval. Rates, terms, and conditions are subject to change.