A Credit Union Built Around You

At Mid-Hudson Valley Federal Credit Union (MHV), you’re more than an account number- you’re the reason we exist. Since 1963, when we began as a credit union for IBM employees in Kingston, we’ve grown to serve over 93,600 members across the Hudson Valley. We offer everything you’d expect- checking, savings, loans, credit cards, mortgages- but what makes us different is how we deliver them: with personalized support, expert guidance, and a genuine investment in your goals. Whether you're getting started, planning ahead, or chasing something big, MHV is here for it all- because your journey is our story.

Trusted by Over 93,600 Members

Your friends, family and neighbors already trust MHV. Now it’s your turn. Join a credit union that puts your goals first-because we succeed when you do.

- I have always been very happy with the friendly service and services offered by the credit union. I have had family and friends join upon my recommendation.Gail H.

- It’s feels like there is a genuine care about the members of the credit union.Teddy F.

- MHVFCU has been an outstanding partner for my small business, and also my personal finances. It is a great place to be a member!Jacqueline R.

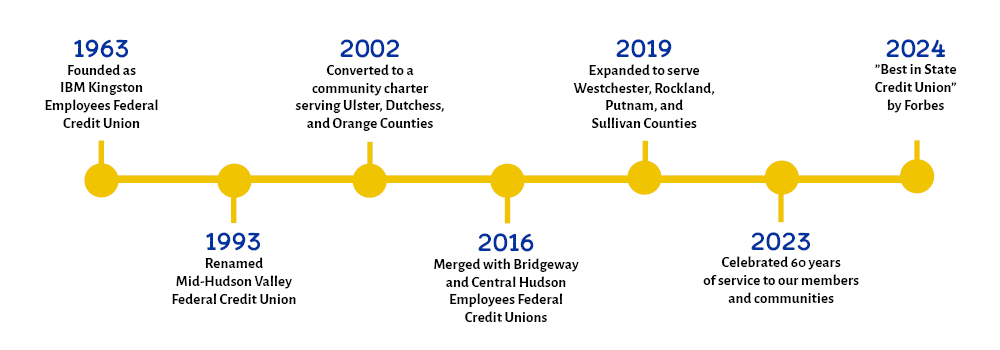

Serving the Hudson Valley, Year After Year

Our history is shaped by the people and communities we serve. From our roots in Kingston, to our present-day impact across the Hudson Valley with 14 locations, your journey is part of our story.

How to Join

- 1

Check Your Eligibility

You can join MHV if you live, work, worship, volunteer, or attend school in: Ulster, Dutchess, Orange, Westchester, Rockland, Putnam, or Sullivan County, NY. Family and household members are welcome, too! - 2

Gather What Your Need

Have these ready:

-U.S. Government-issued ID

-Social Security Number

-Proof of Address

-Additional documents may be needed depending on the account you open - 3

Open Your Account

Open online, by phone, or in person. All you need is a $5 minimum deposit into a savings account to become a member.

Our Board of Directors

Meet the group of volunteer members who guide the direction of the credit union.