Protect Yourself from Fraudulent Calls & Texts

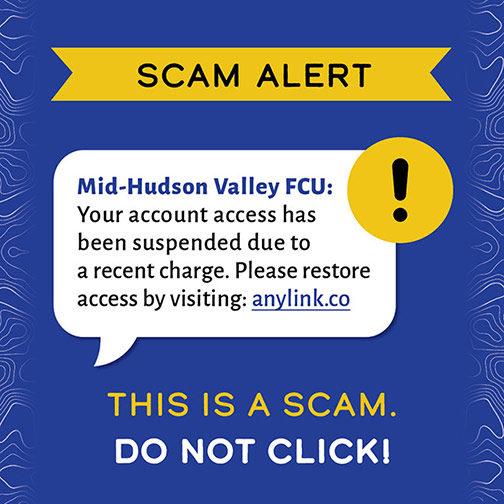

If you get a suspicious call or text claiming to be from MHVFCU - regardless of how legitimate the number appears - ignore it and contact us directly at 845-336-4444. We will never reach out to you via call or text to ask for your account information and we never send text messages with links. If you receive one claiming to be from us, do not click it!

5 Tips for Protecting Your Information and Money

- 1

Be Alert

Many phone and email scams try to get you to share personal information. If you did not initiate the call or the email is from an unknown source or seems suspicious do not provide any information. - 2

Safeguard Your Information

Never share account information or passwords. Be sure to log out after each use. Create strong passwords and change them periodically. - 3

Monitor Your Accounts

Review your bank and credit card statements regularly and request and review your free credit report annually. Set up alerts to notify you of irregular activity. - 4

Protect Your Electronic Device

Make sure your computer, tablet and phone have up-to-date software and antivirus and malware protection. - 5

Take Action

If you notice any suspicious activity, notify us and any other applicable parties as soon as possible.

Questions or concerns about fraud? Call us at 845.336.4444 and a Member Service Representative will be happy to help.

Fraud Deep Dives

Ever wonder how specific scams work? You should – the more you know about them, the better you’ll be able to protect yourself.

Get the details from fraud prevention expert Charles Broe, VP Asset Protection. He takes you into some of the most common scams, revealing how and why they work.

Protect Yourself From Identity Theft

Download our free guide, “The Basics of Identity Theft”, to learn more about identity theft and discover ways to protect your personal and account information.

Keep Your Personal Accounts Secure!

Here are some tips and best practices from leading experts and government resources:

Helpful Articles

Current Money Scams You Need To Know About

What are spoofing, phishing, vishing, smishing? From computer takeovers to gift cards, here are some of the most commons scams and how to protect yourself.