What is the difference between a Personal Loan and a Line of Credit?

So you need a Personal Loan. Or do you need a Personal Line of Credit (LOC)? Aren’t they

basically the same thing? Not exactly, and understanding the key differences will be important

in determining which is the better option for you. Let’s run through three of the biggest

differences between Personal Loans and Lines of Credit:

1. How you Receive the Money

With a Personal Loan you

will receive the full amount that you’re approved for. So, for example, if you apply

for a $5,000 loan and are approved for that amount, you will receive that entire

amount upfront. This is pretty straightforward, although it is important to note

that you may not always be approved for the full amount you apply

for.

Various factors like your credit

score(Opens in a new

window) and your debt-to-income

ratio(Opens in a new

window) will impact the amount a financial institution will

approve you for.

A Line of Credit, on the other hand, provides a set amount

of money that you can draw from, or use, at any time. You may never need the money,

or you may access it regularly. You can draw any amount that you’d like as long as

it’s not more than the total amount you’ve been approved for.

Let’s say

you’re approved for a $5,000 Line of Credit. You can draw and use any amount up to

$5,000. It’s a bit like a credit card in that aspect, without the actual plastic

card. You can keep using and re-using the money available as often as you need it.

As you pay the money that you use back, that amount becomes available

again.

How you’re going to receive the funds is the first step in determining

whether a Personal Loan or a Line of Credit is a better choice for you. Now, think

about what the money will be used for.

2. What the Money Will be Used for

How you plan on using the money will be a big part of deciding if a Personal Loan or

a Line of Credit is a better option for you. Personal Loans provide you with a lump

sum amount, which makes them good options for known expenses. Lines of Credit, on

the other hand, give you the ability to use the money as you need it. That makes

them ideal for unplanned expenses.

Personal Loans give you a lump sum amount.

Because you receive the entire amount upfront, Personal Loans are a good option for

things like making a big purchase, consolidating debt or funding your

education.

► Personal Loans for big purchases

Personal Loans typically have lower interest

rates than credit cards, making them a more attractive option

when you have to drop a sizeable amount of money on a purchase. Plus, they’re what’s

known as a term loan, whereas credit cards are revolving. This simply means that

there’s a defined payoff date with a Personal Loan. This can be very helpful when

budgeting out your monthly payments.

► Personal Loans for consolidating debt

Consolidating multiple credit card payments into a single personal loan payment,

often referred to as debt

consolidation, can often help people manage debt that at first

feels insurmountable. With lower average interest rates than credit cards, Personal

Loans can potentially save you money. Plus, because you’re using a Personal Loan to

pay off the credit cards, you free up your credit capacity which can improve your

credit score.

Watch our quick video for an explanation of debt consolidation.

► Personal Loans for education costs

Once you exhaust your free and lower-cost funding options (scholarships, grants,

federal student aid), a Personal Loan may be able to help you fill any remaining

gap. You can use the funds from your Personal Loan for everything from books to dorm

room essentials. Don’t apply for more than you absolutely need, though, because

Personal Loans are financial obligations. Avoid putting yourself into debt for

anything other than necessities.

Lines of Credit give you money you can use as you need it.

Lines of Credit, because they don’t give you all the money upfront, are good options

for those “just in case” moments. Emergency car repairs, overdraft protection, and

even small ongoing projects are all good candidates for a Line of Credit.

► Lines of Credit for Emergencies

A Line of Credit can provide you with a little peace of mind in the event of an

emergency. Because the money is there and waiting, you can draw on it immediately

rather than having to wait for a loan or credit card approval. Interest rates tend

to be slightly lower than credit cards, too. And because you can transfer funds

directly into your Checking Account, you can easily pay for things like tow trucks

that may not accept cards.

► Lines of Credit for Overdraft Protection

Sometimes we goof and spend more money than we actually have in our Checking Account.

Sometimes, we have to. Whatever the reason, overdraft protection ensures that you’ll

still be able to pay by automatically pulling the funds from another source. For

example, if you swipe your debit card for a $50 purchase but only have $20 in your

Checking Account, your overdraft protection will pull the remaining $30 from another

account.

While you can establish your Savings Account as your overdraft

source, using a Line of Credit protects the money you’ve been setting aside. Opening

a Line of Credit for overdraft means you’ll be able to pay for items and maintain

the integrity of your Savings Account. It’s important to note that overdraft is

there for your protection, not as a free pass to purchase items you cannot currently

afford.

► Lines of Credit for Small Projects

If you have small ongoing projects that you will occasionally need to fund, a Line of Credit may be perfect for you. Rather than receive all the money upfront – and having to set it aside – drawing from a Line of Credit as you need funds can make managing the money a little easier. There will be a maximum amount you can apply for though, so if you have larger projects like home renovations you may want to look into a Home Equity product(Opens in a new window) instead.

3. Interest Rates on Personal Loans and Lines of Credit

The interest rates will differ on Personal Loans and Lines of Credit and, in addition

to how you receive the money and what it will be used for, may help you decide which

is the better option.

Interest rates on Personal Loans are typically lower

than those on Lines of Credit. This is simply because Lines of Credit are often seen

by lenders as a riskier type of loan. Because you receive all of the funds upfront

with a Personal Loan, though, you’ll be paying interest on that entire amount from

the get-go. With a Line of Credit, the interest rate will likely be higher, but you

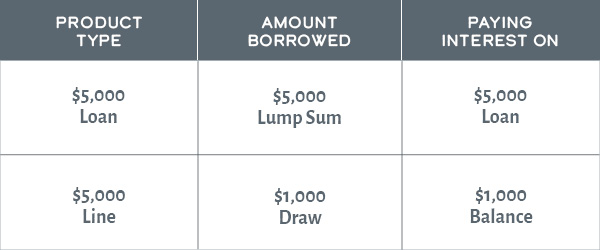

only pay interest on the money you actually use. If you have a line of $5,000 but

only draw $1,000, you’ll only be charged interest on that $1,000. See the below

example.

This makes understanding how you’re going to use the money even more important.

If you know you’ll need a certain amount upfront, a Personal Loan may be a better

option as it will likely have a lower interest rate. If you’re not sure how much

you’ll need, though, or want an emergency fund, a Line of Credit may be a better

choice as you won’t be charged interest on the money you don’t use.

It’s

always a good idea to talk to your financial institution to help you determine if a

Personal Loan or a Line of Credit is a better option for you, but understanding how

you receive the funds, what the money will be used for, and the difference in

interest rates will give you a solid start.

Other Credit, Loans and Debt articles you may be interested in

- Couple applying for a personal loanCredit, Loans and Debt

Can I Spend My Personal Loan on Anything?

Can you really use a personal loan for anything? Just about. Here’s how personal loans work, why they’re often better than credit cards, and the 4 most common uses. - Couple looking concernedCredit, Loans and Debt

Does Refinancing Impact my Credit Score?

Ever thought about refinancing your car loan or mortgage? Then you’ve probably wondered what will happen to your credit score if you do refinance.