Let’s face it: the word “budget” might make you want to scroll on by. Many of us tune out when finances come up, but what if budgeting could be easier?

Meet Anita, MHV’s Woodstock Branch Manager, who’s helped countless members take control of their finances with a simple strategy- the 50-30-20 rule. It might just be the game-changer you’ve been looking for.

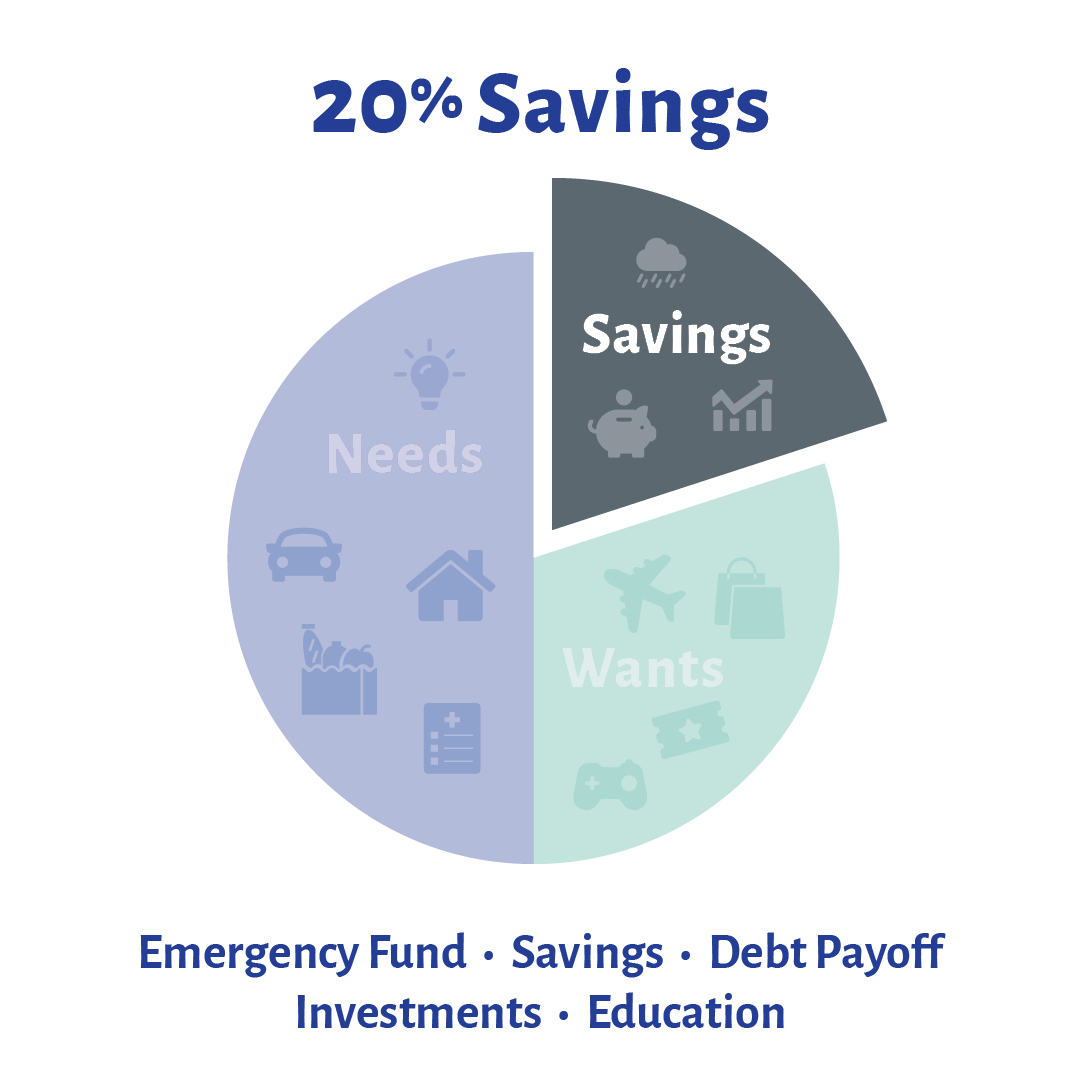

Here’s how it works: divide your income into three categories- 50% for needs, 30% for wants, and 20% for savings. Sounds simple, right? It is- and the best part is, it works.

But what if your “needs” (like rent, bills and groceries) take up more than half your income? Anita’s advice is practical: “Re-evaluate your needs. Sometimes we call things ‘needs’ that are really ‘wants.’” For example, if you need new sneakers, you don’t have to splurge on $200 shoes. Or, if you need new glasses, you don’t need designer frames. Small shifts like this free up room for savings and investments that matter more.

For anyone new to budgeting, Anita suggests a simple method: “Create three separate accounts—one for needs, one for wants, and one for savings. Then, set up automatic transfers(Opens in a new window) on payday so that 50% goes to needs, 30% to wants, and 20% to savings.” This way, your money automatically goes to the right place without you having to track it constantly. You can even give your accounts nicknames(Opens in a new window) in Digital Banking to make it easier.

Still not convinced? Here’s a real success story: One member, dreaming of a vacation with their daughter, couldn’t seem to save enough. After examining their spending, they realized they were dropping $16 a day on energy drinks- $80 a week, over $4,000 a year! By reallocating that money, they were able to save for the trip.

Anita says: “Once you start using the 50-30-20 rule, you’ll quickly see where to move things from the ‘needs’ to the ‘wants’ category. It helps you pause and make more intentional spending (and saving) decisions.”

Other Saving and Budgeting articles you may be interested in

- Recent grad taking a photo with family memberSaving and Budgeting

Am I Saving for My Kid’s Future the Right Way?

529 Plan or Trust? Which is better for your child’s future? Get the definitive breakdown of each savings tool. Find confidence in how you’re planning for your children. - Buying GroceriesSaving and Budgeting

Top 6 Ways to Save Money on Groceries

Ever experience that, “I’m sorry, how much?!” moment in the grocery store? You know – the one that makes you look back at your cart and wonder how so little could cost so much? - 4 Things to Avoid During InflationSaving and Budgeting

Don't Do These 4 Things When There’s High Inflation

Inflation is scary. But you can navigate it like a pro. Start by avoiding these 4 common money mistakes.