Understanding DTI and how it impacts your chances of getting a loan or credit card

Chances are, you know that your credit score is going to be a critical factor in how lenders will

decide whether or not to give you a loan. But, your debt-to-income ratio (DTI) is a number you

need to be familiar with, too, especially if you plan on applying for any type of loan or

mortgage.

What is DTI?

OK, so what exactly is your debt-to-income (DTI) ratio? Quite simply DTI is a measurement that compares your gross monthly income against your monthly debt payments.

To calculate this ratio, you’ll need to add up all of your monthly debt payments: housing,

car loan, personal loan, credit card, student loan, etc. Then, divide that number by your gross

monthly income, or, the income you receive before your deductions. The answer will be a

fraction, so multiply it by 100 to get your percentage. That percentage is your DTI ratio.

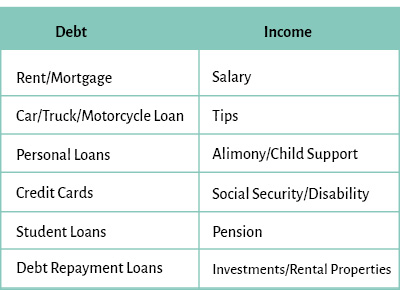

What items are considered debt and income in calculating DTI?

When calculating your DTI, it’s important to include all of your income sources and all of your

debts. The chart below outlines what items are typically within each category. Keep in mind that

any loans you co-signed for will also be included as debts.

Why is DTI Important?

When you apply for a loan, mortgage or credit card, lenders are going to look at several factors to determine whether you’ll be able to afford your payment. Your credit score(Opens in a new window) will be a factor in determining your eligibility and the interest rate you’ll get.

But your DTI ratio is important because it demonstrates to lenders how much of your income is

already going towards debt. A lower DTI ratio means that a smaller percentage of your income is

allocated to paying your current debts. In the eyes of a lender, this is a good thing because it

means you are more likely to handle additional debt well. In other words, if you are already

allocating a large percentage of your income to paying monthly bills, it will be harder for you

to adjust to and pay additional debt without getting yourself into a tricky financial

situation.

This is why calculating and understanding your DTI is important to do – before

you start applying for your loan or mortgage. If your DTI is too high, you may be denied for

your loan, even if you have a good credit score. Lenders won’t want to risk lending to someone

who is already spending too much of their income on monthly payments. Even if your DTI isn’t

currently considered too high, you’ll need to keep in mind that it’s going to increase if you

get approved for your loan or mortgage as you’ll be taking on more debt.

What’s a good DTI?

DTI thresholds are product-based, meaning that lenders will accept different DTIs if you’re applying for a car loan than they might if you’re applying for a mortgage. As a very general rule of thumb, lenders are going to want to see a DTI of no more than 43% if you’re applying for a mortgage, meaning they want to know that no more than 43% of your income is currently being used to pay debt, but for consumer loans (personal loans, auto loans, etc.) lenders may allow a much higher DTI. It’s important to remember, however, that allocating so much of your income to paying down debt may lead to increased financial stress.

Most often, lenders prefer that no more than 33% of your income is going towards rent or mortgage payments. It’s important to talk to your financial institution to understand their thresholds for the type of loan you’ll be applying for.

How Do I Improve My DTI?

If you’ve calculated your debt-to-income ratio and it is above the typical desired percentage, it will be worth taking the time to lower that number before applying for any loans or a mortgage. Improving your DTI requires either eliminating some of your debt or increasing your income. Eliminating debt may seem overwhelming at first, but it will put you in a more financially secure position in the long run. You have a few options when it comes to eliminating some of your debt.

- Use a budget tool(Opens in a new window) to determine where you can cut back on some of your spending. Then, reallocate that money towards paying down some of your debt. If your debt is mostly credit card balances, try to stop using them to give yourself a chance to reduce the balance.

Consider debt consolidation(Opens in a new window) if you are paying several higher rate obligations, especially credit cards. Consolidating your debt will very often reduce the interest that you’re paying, meaning more of your monthly payment will go towards paying down the balance.

- Explore refinancing if you have a higher rate card or student loan. Refinancing may allow you to lower your rate, helping you to put more of your monthly payment towards paying down the debt.

- Talk to your financial institution. It’s likely that they can outline several possible solutions for you, including some of those listed above.

Understanding both your credit and your DTI will help you be better prepared for your loan or

mortgage application. Speak to your lender to get a sense of what their lending criteria is, and

be sure you fall within those parameters before you apply.

1 -

https://www.experian.com/blogs/ask-experian/credit-education/debt-to-income-ratio/

Other Credit, Loans and Debt articles you may be interested in

- Couple applying for a personal loanCredit, Loans and Debt

Can I Spend My Personal Loan on Anything?

Can you really use a personal loan for anything? Just about. Here’s how personal loans work, why they’re often better than credit cards, and the 4 most common uses. - Couple looking concernedCredit, Loans and Debt

Does Refinancing Impact my Credit Score?

Ever thought about refinancing your car loan or mortgage? Then you’ve probably wondered what will happen to your credit score if you do refinance. - family looking at documentCredit, Loans and Debt

Personal Loans vs. Lines of Credit

So you need a Personal Loan. Or do you need a Personal Line of Credit (LOC) Aren’t they basically the same thing? Not exactly, and understanding the key differences will be important in determining which is the better option for you. Let's run through three of the biggest differences between Personal Loans and Lines of Credit.