How to Feel Like You’re Making Smart Money Moves

Want to feel like you’re making smart money moves? Picking a savings tool that matches your

savings goal will definitely help. We tend to limit our thinking to the basic Savings Account.

And while there’s nothing wrong with a Savings Account(Opens in a new window), there are

options that may be better for you.

Here are four different savings tools to help you

reach your goals.

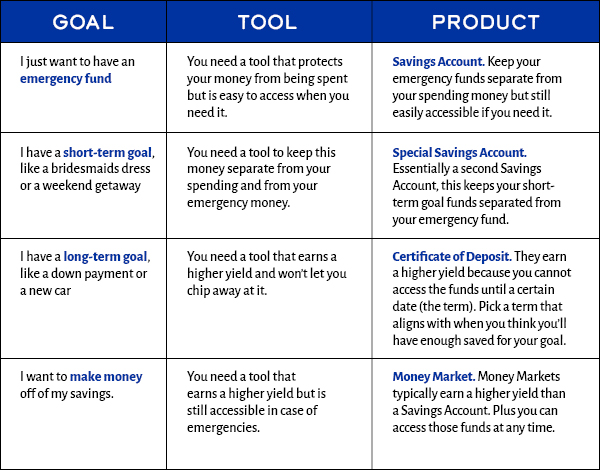

I Just Want to Have an Emergency Fund

If your main goal is building up an emergency account, you should consider a savings product that does two things:

Protects your money, and

Keeps it accessible.

The whole point of an emergency fund is to separate it from the money you will be

spending. At the same time, you need to be able to access the money quickly and

easily if you do have an emergency. In this case, a basic Savings Account(Opens in a new window) may

be your best solution.

With a Savings Account, you can make regular deposits

and establish automatic transfers to build your balance. You won’t be tempted to

spend the money since it’s not in your Checking Account. Yet you can withdraw funds

if you do find yourself in a financial bind.

You can finally have a Savings Account that makes you proud. Listen in to the “Easiest Ways to Start Saving Money” podcast episode. In just 14 minutes, you’ll get easy-to-do steps on how to find money to put into Savings. I Want to Listen(Opens in a new window)

I Have a Short-Term Savings Goal

Not all goals are years in the future. Maybe you need to pony up for a bridesmaid’s

dress or tux. Maybe you want to take a much-needed getaway. The smart financial

decision is saving up for these expenses, rather than swiping your card. Who wants

to pay for a bridesmaid’s dress for the next year?

When you have short-term

goals, you want to keep the cash accessible but removed from your spending money and

your emergency savings. Your best bet is to open a Special Savings

Account.

Just like your basic Savings Account, this Special Savings Account

allows for regular deposits and automatic transfers to build the balance. And there

are no penalties for withdrawing money, unless your financial institution requires a

minimum balance.

Set and smash your savings goals. Financial Tools already lives in Digital Banking and the MHV Mobile App. You just need to pop in and set up your goals. Get started with your goals today.

I Have a Long-Term Savings Goal

Long-term savings goals include expenses like a down payment for a car or house,

college savings, even retirement planning. When planning for the long game, you

should take advantage of that timeframe to earn some money on your

savings.

Savings products earn interest. Even your basic Savings Account

does. With basic accounts, though, the amount you earn tends to be quite low (think

less than 1%). So if you know you have a chunk of time to save, a product that has a

higher yield tied to a term length can benefit you.

Consider Certificates of

Deposit. Certificates earn higher interest because you’re not allowed to access the

funds for a certain period of time, also known as the term. Because your financial

institution keeps the funds on deposit for a longer period of time, you’re rewarded

with a higher yield. There are various term lengths, including terms as short as a

month up to 5 years or more.

Unlike Savings Accounts, you cannot usually make

regular deposits into a Certificate nor can you withdraw the money early without

incurring a penalty. For this reason, it’s important to pick a term that aligns with

when you think you’ll need the money. For example, if you plan on buying a house in

3 years, you wouldn’t commit to a Certificate with a 5-year term.

Because you

can’t access the money you’ve put into a Certificate of Deposit prior to the term

date, they aren’t ideal for an emergency Savings Account.

You’re ready to start savings, but not sure where to start.

Get your free guide on How to Master Your Money for all the tips and techniques you need to get going.

I Want My Savings to Earn Money

You may be somewhere between a basic Savings Account and a Certificate of Deposit.

Isn’t there a way to make money on your savings but still be able to access your

money?

Yes! Money Markets are a great alternative. Interest earned on your

Money Market balance is usually higher than a basic Savings Account, yet you can

access the funds as you need them.

Money Markets also allow regular deposits

so you can continuously build your balance. You can often write a certain number of

checks against your Money Market, too, which can be handy if you have emergency

repairs pop up.

Money Markets often have balance requirements, though, so if

your account drops below that required amount you will incur a fee. If you’re

considering a Money Market, you may want to maintain a basic Savings Account as

well.

Picking a savings

tool that matches your goal will help you feel financially confident. You’ll know

you’re making smart money moves. It’s a big decision, though, and you can also

talk to us(Opens in a new

window) about which may be the best option for

you.

Other Saving and Budgeting articles you may be interested in

- Recent grad taking a photo with family memberSaving and Budgeting

Am I Saving for My Kid’s Future the Right Way?

529 Plan or Trust? Which is better for your child’s future? Get the definitive breakdown of each savings tool. Find confidence in how you’re planning for your children. - Buying GroceriesSaving and Budgeting

Top 6 Ways to Save Money on Groceries

Ever experience that, “I’m sorry, how much?!” moment in the grocery store? You know – the one that makes you look back at your cart and wonder how so little could cost so much? - 4 Things to Avoid During InflationSaving and Budgeting

Don't Do These 4 Things When There’s High Inflation

Inflation is scary. But you can navigate it like a pro. Start by avoiding these 4 common money mistakes.