What Are Fintechs? How Are They Different Than Banks or Credit Unions?

FinTech is short for Financial Technology. As defined by Investopedia(Opens in a new window), it is the blanket term “used to describe new tech that seeks to improve and automate the delivery and use of financial services.” FinTech is often used to talk about digital-only banking solutions – think Mint, Ally, or Affirm. It can also refer to the technology that traditional financial institutions adopt to enable digital banking for their customers or members.

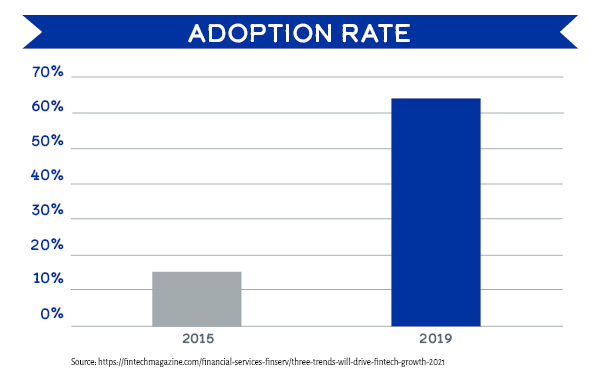

FinTech Adoption Rate

The most obvious difference between FinTechs and banks or credit unions? Their lack of physical locations. While most traditional banks and credit unions now offer digital banking – online banking and mobile banking apps almost always accompany an account – they also continue to offer branch locations for people who prefer face-to-face transactions. For some, this is an important distinction.

Other differences can be divided between things people love about FinTechs and things…well, things people really don’t like. And somewhere along that divide you can decide where your own preferences land.

Here’s What People Love About FinTechs

▸Convenience

Without a doubt, the most-cited benefit of banking with FinTechs is their convenience. While some

people turned to FinTech during the pandemic – touchless banking felt safer – FinTech Magazine(Opens in a new window) believes that,

“while COVID drove adoption of contactless technology, desire for convenience will carry it

further.” With their always-open business model, FinTech transactions aren’t limited by

traditional bank hours. Some experts(Opens in a new window) contend that

FinTechs are doing to banking what Amazon has done for shopping. While banking may not yet be as

exciting as Amazon’s extensive product availability and next-day delivery, FinTechs are

certainly helping reshape its traditionally dull personality.

Traditional banks and

credit unions aren’t oblivious to people’s expectations for convenience. Most traditional

financial institutions offer digital banking tools,

including online banking and mobile apps. These tools allow 24/7 banking – transfers, bill

payments, even check deposits can be done on your time.

▸Cashless

The pandemic led to a lot of changes, including a new-found preference for cashless transactions.

Many businesses opted to accept cards only – some permanently. According to Business Wire(Opens in a new window), the share of

cashless businesses in the US, UK, Canada, and Australia has more than doubled since

pre-pandemic times. Statistical data supports the cashless ideology: Forbes(Opens in a

new window) reports that 70% of consumers prefer paying with a card versus

22% who prefer paying with cash.

Are there drawbacks to being a cashless system?

Absolutely. More on that below.

▸Lending

Easier and faster access to loans has also converted people

to FinTechs. According to Data Science Central(Opens in a new window), the

“advancements of fintech have made it possible for online or digital lenders to deal with the

application and approval process within a day.” The loan approval process traditionally took

time – and a visit to a branch. FinTechs make applying for loans fast and easy. And they often

have more relaxed lending guidelines, looking at personal information(Opens in a new window) outside of an

applicant’s credit score to determine eligibility.

This is great news for people

carrying below-average credit scores who need a loan. But it’s not without its risks. While the

average delinquency rate(Opens in a new window) for traditional

financial institutions sits around 1.77%, the average delinquency rate for FinTechs is 3.53%. In

other words, while the accessibility of loans created by FinTechs is a potential windfall for

some, it puts others in an unsustainable financial position – putting that segment of consumers

into a deeper financial hole.

Get this: There are behaviors that people do every day that impact their credit score. Are you doing them, too? Listen to this 13-minute podcast episode to find out. Listen Now(Opens in a new window)

Here’s What People Don’t Like About FinTechs

▸Customer Service

A quick trip through Reddit or TrustPilot reveals people’s biggest frustration with FinTechs: a lack of customer service. Couple this with the fact that there are no physical locations to visit, people who need help often feel left out to dry. Consider these TrustPilot reviews from users of a popular FinTech app:

“I am doing my best to get away from this company. They hide behind an app, and once

you’re in, you’re hooked. I tried to get to live support, and it was the worst

experience I have ever had with another person, much less a representative of a

company.”

“I would give zero stars if I could. Customer service is terrible.

I had an employee supposedly handling a financial matter. The person I was dealing

with at **** stopped responding. It took me about a week to reach anyone else at

**** and I was told the person I dealt with was on vacation. My account and my money

were left dangling for a total of 3 weeks, without my having an access to it after

what was supposed to be an easy transfer from another financial institution.”

The convenience of digital banking can’t be denied. But when deciding on a primary financial institution, consider how you will access support when you need it. Think about situations when:

Your debit card is lost or stops working

You experience fraud on your account

You are unclear about a series of transactions

Your direct deposit didn’t post

▸No or Costly Cash Deposits

We’ve talked about the ease and security of going cashless, but we’re not a

completely cashless society. If you have cash, how do you deposit this into a

digital bank? Some FinTechs allow ATM deposits – for a fee. With others, though, you

may have to deposit the cash into an account at a traditional bank or credit

union…then transfer that amount into your FinTech account. The Balance(Opens in a new window)

agrees, pointing out that while cash deposits with digital-only banks aren’t

impossible, they are going to be harder.

For some, this may not be an

issue. If you never receive cash, you won’t need to deposit it. But for others, the

ability – or lack thereof – to deposit cash is a dealbreaker. If you’re thinking

about making a FinTech your primary account, plan for how you’ll handle payments,

gifts, or allowances you receive in cash.

Member with MHV? Congratulations – you have access to over 118,000 totally-free

ATMs. Yep. No fees. No surcharges. Find one near you.

Use the

Locator

▸Trust Struggles

This is a bit more nebulous, but still a factor for some who prefer a traditional

bank or credit union. When banking with a traditional financial institution, there

is a known entity: you are dealing with a bank or credit union that you know and

see. When banking with a digital-only bank, your loan may be serviced by one

institution while your deposit is handled by another, all under the name of a single

FinTech.

This creates a trust issue. Technology – while widely embraced – is

still outpacing the public’s buildup of trust in it. Data breaches, privacy

concerns, and increased security by major brands like Apple contribute to the notion

that technology isn’t always “good”. And if technology isn’t seen

as good(Opens in a new

window), FinTechs have an uphill battle in winning

consumer trust. Compounding the issue? A perceived lack of regulation. Banks and

credit unions operate under the scrutiny of government regulators. FinTechs,

however, have grown faster than regulations can keep up with.

The Wall Street

Journal(Opens in a new

window) reported that the Bank of International

Settlements found “tech companies that play a critical role in payments and other

areas should be subject to stricter regulatory scrutiny that considers issues beyond

traditional market risks.” Consumers trust banks and credit unions, knowing that

there are protections in place. When that protection becomes a question mark – as it

may be when considering a FinTech account – people feel less inclined to give that

FinTech their primary account.

How do I pick a financial institution? Get tips for deciding where to bank in this 6-minute Friday Financial video. Watch it Now(Opens in a new window)

So Which is Better: FinTechs or Banks and Credit Unions?

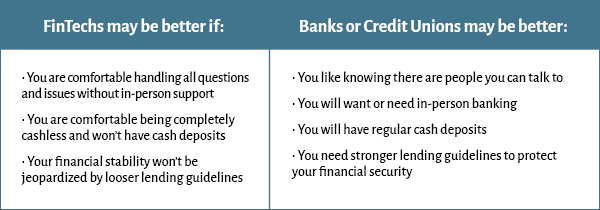

As with so many questions, the answer is: it depends. When deciding whether you want to bank with a FinTech or a traditional financial institution, consider the following:

Your customer service preference

How frequently you’ll need to deposit cash

The impact of easier access to loans to your financial security

Most banks and credit unions offer a healthy digital banking platform – combining the convenience and security of FinTech with the service and trust of traditional financial institutions. If you’re curious about the FinTech experience, test the waters: open a second checking or savings account with a digital-only bank. Ultimately, where you bank is a decision that only you can make…after considering pros and cons of both digital-only and traditional financial institutions.

Other Lifestyle articles you may be interested in

- Couple having fun in the outdoorsLifestyle

Have the Freedom to Take the Vacation You Want

Take the vacation you desire, on your terms. Get tips for budget-friendly travel and financial tools to make saving for a dream vacation a breeze. - Couple managing financial stressLifestyle

How do I Reduce Financial Stress?

Can you imagine a completely stress-free life? Neither can we. But there are ways to manage your stress – especially when it’s financial stress – that can make your day-to-day a little easier.